Energy. It is the perennial election issue in Ontario, and for good reasons. A series of provincial decisions spanning decades has led to long-term structural problems in the electricity sector. As a result, since 2010, electricity prices have risen dramatically. Predictably, so has inequality and energy poverty.

Successive governments have tackled the problem of high electricity prices with short-term schemes designed to win elections. The latest such scheme, the Wynne government’s so-called Fair Hydro Plan, will lower electricity prices in the near term but eventually saddle ratepayers with steep repayment obligations and even higher utility bills in the future.

There is a way out of this quagmire, but only if we are honest about the province’s past mistakes, in particular Ontario’s overreliance on the private sector.

Rising prices and electricity poverty

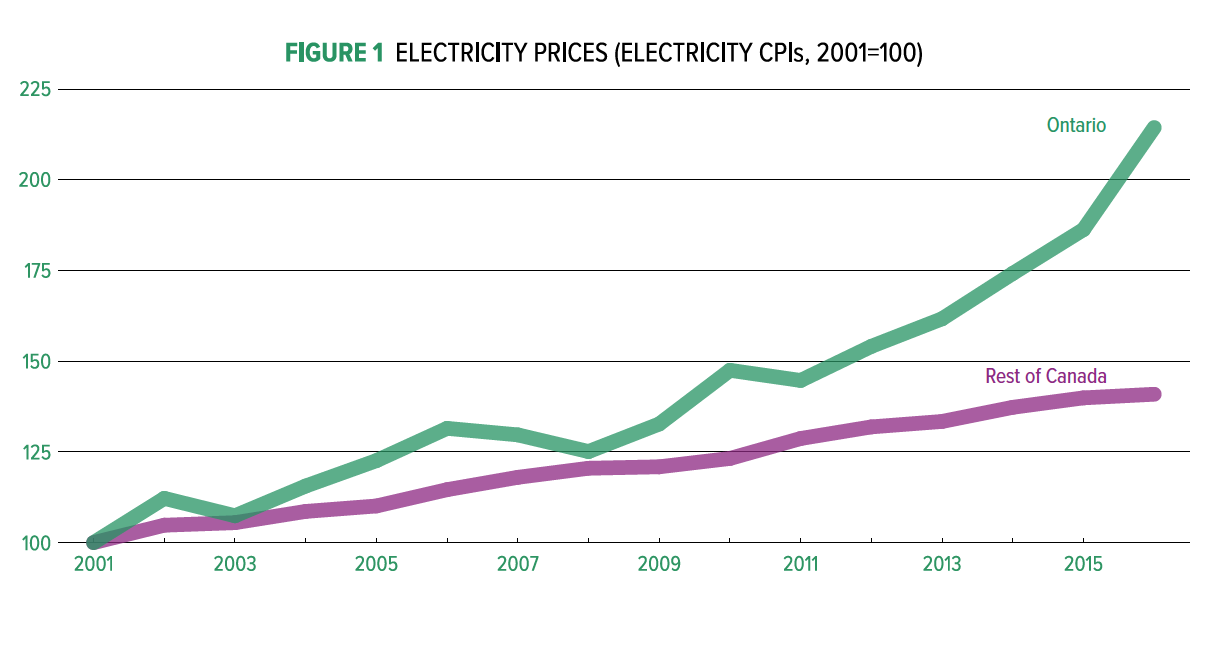

As shown in Figure 1, Ontario’s retail electricity prices more than doubled from 2001 to 2016 (almost three times as much as in the rest of Canada) and increased 7% a year between 2010 and 2016. The unprecedented and prolonged price hike has been felt throughout the province, but the additional burden has hit lower-income households very hard.

For households that pay their hydro bills directly, Figure 2 shows that the bottom 20% of Ontario households by income paid about $1,600 in electricity bills in 2016, accounting for about 7.6% of their income (the same group spent just 5.4% of income on electricity in 2001). In contrast, low income households in the rest of Canada pay about $1,100 per year. (On average, Ontario households pay 2% of their income on electricity.) As lower-income families devote a growing portion of already inadequate incomes to electricity bills, electricity poverty increases.

Like many other provinces, Ontario used to have an integrated public utility monopoly providing electricity generation, transmission and distribution to consumers. In 1999, a few months before that year’s provincial election, the Progressive Conservative (PC) government of Mike Harris split the public utility, then called Ontario Hydro, into Hydro One (transmission and distribution in rural areas), Ontario Power Generation (OPG) and several other entities, all with a view to enabling competition and privatization in a new electricity market. (Legislation to decommission the monopoly had been passed the previous year.)

The PCs claimed that government “interference” was to blame for Ontario Hydro’s lacklustre performance and high debt. To kick-start the new market, the province mandated that OPG reduce its dominant market share in generation, including by “de-controlling” a portion of its assets. OPG did this by entering into a long-term lease arrangement (a public-private partnership where the province maintains ownership but the assets are privately managed) for nuclear power generation in the Bruce Peninsula with what is now Bruce Power.

Four years later, on the eve of the 2003 election, four electricity generation technologies (nuclear, hydro, coal and gas) accounted for almost all installed capacity in Ontario. The Liberals were campaigning on a plan to phase out about 7.5 gigawatts (GW) of coal capacity, which accounted for about a quarter of overall capacity. They claimed that to reliably “keep the lights on,” the province would need to come up with a system different from the PCs to ensure sufficient replacement generation.

The Liberals, after winning that election, would eventually fulfil their promise to phase out coal power while increasing the province’s installed capacity of renewable (wind and solar) energy. Unfortunately, a policy of private unregulated generation of electricity would all but ensure prices would climb. The lights would stay on and the grid would become greener, but at an unreasonable cost for consumers.

Stealth privatization

The Liberal government of Dalton McGuinty decided that all new power generation would be provided by the private sector. OPG generated virtually all provincial electricity before it was required to spin-off Bruce Power; today it controls less than 40% of installed capacity (now mostly nuclear and hydro), while Bruce Power holds 15% or so, and private and independent power producers account for about the remaining 45%. In effect, the Liberals implemented the PC vision of electricity privatization.

This long-term shift from public to private power had a number of implications, including with respect to price. Figure 3 shows how total generation payments increased by more than two-thirds from 2006 to 2017, reaching almost $15 billion last year. Bruce Power and OPG revenues have been relatively stable over the period, while those of private and independent generators have increased sevenfold. In the context of flat or declining demand, this increase in payments resulted in higher overall prices that were passed on to consumers.

But not all prices increased equally. Figure 4 shows that OPG and Bruce Power have produced electricity in a narrow range around $60 per megawatt hour (MWh). In contrast, prices for private and independent generators have increased by about 14% a year over the last decade (those prices are now more three times higher than what OPG and Bruce charge). It was only natural: the private entities demanded additional returns that a compliant government was eager to provide in return for achieving its sector vision.

Policy by contract

Once the Liberal government had decided on private infrastructure, it adopted a unique contract-based regime for these power producers that, unlike most OPG assets, was not subject to economic regulation by the Ontario Energy Board (OEB). Rather than relying on the wholesale market price to drive private investment, as would have been the case under the Harris government’s 2002 market, the Liberals determined that the risk of insufficient private investment required entering into long-term contracts that guaranteed producers a fixed price for 20 years.

In addition to paying the wholesale price, consumers are required to also pay the differential between it and the higher contract price. This differential is the infamous global adjustment (GA) embedded in provincial hydro bills. Ontario centralized all contracting under the newly created Ontario Power Authority (OPA), whose functions were taken over by the wholesale market operator (the Independent Electricity System Operator, IESO), and virtually all new private sector generation has since occurred via OPA/IESO contracts.

In total, more than 30,000 contracts are managed under this the OPA/IESO system. Most are standing offer arrangements (SOAs) that guaranteed prices for any qualified takers. This includes the feed-in tariff (FIT) program introduced after the passage of the 2009 Clean Energy Act, which is split into small “micro-FIT” contracts and larger projects. Micro-FITs, generally small-scale household solar rooftop installations, account for about 85% of all contracts but less than 1% of capacity. Another 4,000 larger FITs account for about 10% of capacity. The remaining 300-odd contracts are generally industrial-sized, accounting for 85% of contracted capacity, and have been negotiated bilaterally with OPA or were awarded competitively.

Ontario’s auditor general has noted that FIT prices in the province were significantly higher than in other jurisdictions with a feed-in tariff program. It is hardly surprising that Ontario’s open-ended, guaranteed contracts for power purchases attracted investment multiple times the initial expectations; higher prices for electricity were grandfathered in, even as FIT rates dropped with each subsequent program rollout, hence its “gold-rush” nature.

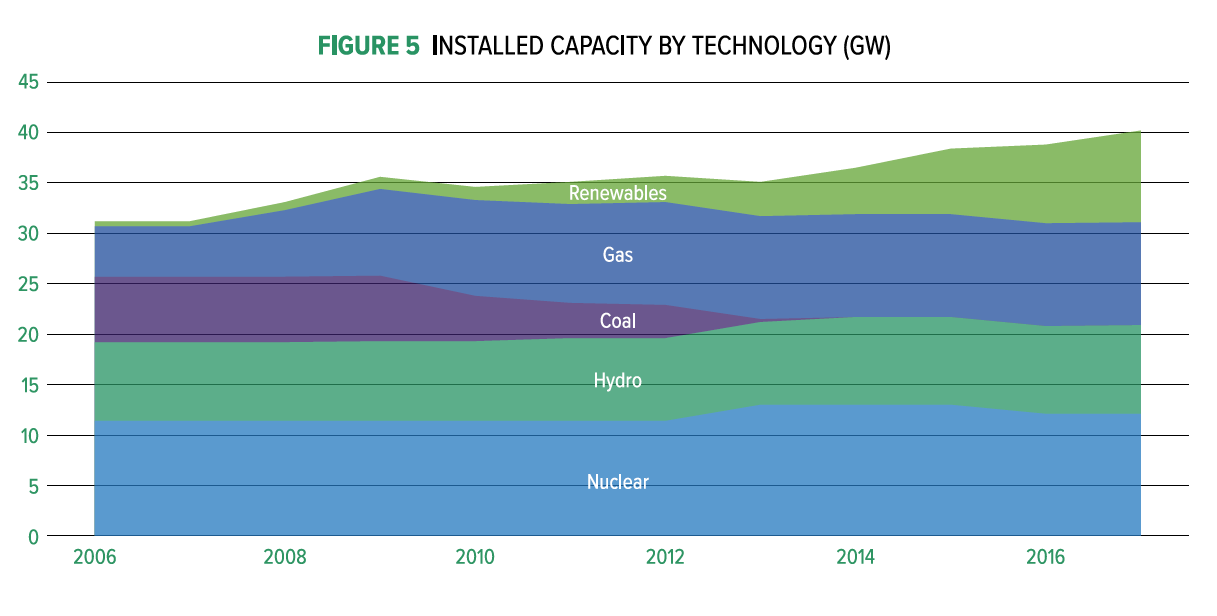

Because renewables are intermittent generation technologies, they also needed to be supplemented by additional gas plants, which increased in tandem with renewables. On top of this, the province negotiated several large-scale renewable and gas projects bilaterally, likely resulting in higher prices to consumers relative to a competitive procurement. Figure 5 shows the increase in gas capacity as coal is phased out and renewables take off, which significantly reduced emissions and pollution from the Ontario power sector.

Ontario’s low-income households paid a high price for the province front-end loading the transition to renewables and not building in any flexibility in its 20-year contracts. From being relatively very expensive a decade ago, some renewables will soon be comparable in price to traditional generation technologies. The irony is that Ontario will not be able to take advantage of those lower prices because current (over) capacity, another symptom of sector mismanagement, is likely to be sufficient for at least half a decade. In the meantime, consumers will continue to pay high “baked in” prices contracted by OPA in the gold rush starting in 2009.

Renewable capitalists

One of the ways the Ontario government promoted the energy transition process was by pointing out that in Germany, a benchmark country for the energy transition and one on which the Green Energy Act was modelled, perhaps up to half of renewables contracts had been taken up by co-operatives and other non-commercial entities, thus “democratizing” the supply of electricity. The reality in Ontario, however, is that even after a decade, less than 5% of renewables contracts were actually taken up by co-operatives.

This inequality of opportunity, with large corporations taking up the vast majority of new renewable energy generation, is also reflected at the household level. While no such data exists for Ontario, evidence from the United States suggests that higher-income households are many more times as likely as low-income households to install rooftop solar panels under the micro-FIT programs.

Rising prices and the electoral cycle

As rising electricity prices naturally became a perennial electoral liability, governments devised financing schemes to temporarily reduce prices or push increases down the road. Prior to 2002, various governments had required Ontario Hydro to defer costs and/or take on debt to keep prices at politically acceptable levels. After market opening, governments had to use other methods, including taking on new debt and paying out of current revenues (i.e., from the tax base).

The Fair Hydro Plan (FHP), implemented by the current Wynne government in anticipation of the June 2018 election, is just the latest variation of these financing schemes. Ontario consumers received an across-the-board 25% reduction in electricity prices in 2017, consisting of 17% from the deferral of certain payments to power producers (the GA on electricity bills) and 8% from the rebate of the provincial portion of the HST (financed from the tax base).

The FHP’s 17% (and subsequent) reductions are financed from the “rate base” and mostly funded by new borrowing of $18.5 billion, according to the Financial Accountability Officer, to be taken in installments of $1 to $2 billion per year and paid back, along with $21 billion in interest, over a 20-year period. That is some short-term gain for a lot of long-term pain, as illustrated in Figure 6. The FHP is also an expensive universal program in that it provides the same percentage decrease to low- and high-income households. This is in contrast to the belatedly introduced (2017) Ontario Electricity Energy Program (OESP), which provides targeted electricity bill reductions to some low-income households.

It’s easy to see why the Liberal government and the auditor general are feuding over the nature of this financing and whether (or how) it should be accounted for in the province’s books. Most of the financing will be done through a new special purpose vehicle (SPV), and involves a first-in-Canada structured financing product. Throughout this whole process producers continue to get 100% of their payment.

In essence, the province will make up the 17% difference between the price producers earn for power and what consumers are paying under the FHP by issuing ratepayer obligation charge bonds. Based on a direction from the energy minister, the first tranche of these bonds ($500 million), issued by the SPV in February, was scooped up by investors.

The SPV paid CIBC World Markets, RBC Securities and Goldman Sachs Canada a total of $2 million in commissions, while the other nine investment banks netted a total of half a million. In the future, bondholders will recover their principal and interest directly from ratepayers via the “Clean Energy Adjustment” line item that will be added to electricity bills in Ontario.

The Liberal government will continue the Fair Hydro Plan if returned to power. The PCs and NDP both voted against the FHP-enabling legislation, but neither has yet clearly stated what they would do if elected. Neither has the Green Party. They’ll need to figure that out quickly.

The FHP requires the energy minister to actively approve borrowing to keep prices low. The Liberal government will continue the Fair Hydro Plan if returned to power. If the government changes, whether to approve such borrowing will be one of the first decisions faced by the new minister. If not, prices will spike 17% overnight.

The PCs and NDP both voted against the FHP-enabling legislation, but neither has yet clearly stated what they would do if elected. Neither has the Green Party. Will they continue to borrow under a scheme they've criticized or allow prices to go back up to pre-FHP levels, or something in between? They'll need to figure that out quickly.

What should be done?

The FHP is an expensive non-solution to a long-standing structural problem. The main driver of Ontario’s inflated electricity cost structure has been the adoption of regulation-exempt, long-term contracts to procure new private sector generation capacity at above market prices.

The government has belatedly indicated it will implement more flexible and less costly means to procure capacity in future, but that the solution will not “extract value from contracts,” thus failing to address the legacy of thousands of long-term contracts that have ratepayers on the hook for another generation.

Both the PCs and NDP have mentioned they would review some contracts but have been unclear about what exactly that would look like. There are several options available for such a review.

First, it is important to create a hierarchy of contracts to understand the task at hand. At the top of that list (first tier) could be those new (non– OPG or Bruce Power) contracts that were not competitively sourced and whose contract price was established via bilateral negotiation or an SOA. Altogether these account for perhaps 11 GW of installed capacity and in the range of $4-5 billion in annual revenues. The other (second tier) contracts could also be looked at if necessary.

Second, it is important to note that the review, whatever shape it takes, would not be an easy or fast process, and would be subject to legal and political risk, since some of these contracts include confidential termination and other compensation provisions if unilaterally amended by the government.

The energy minister would need a top-notch multi-tiered negotiating strategy to deal separately with industrial and SOA-type contracts covering all technologies, all backed by a willingness to cancel some contracts. Under this last-case option the affected power producers would no longer receive the GA above the wholesale market price. In tandem, the provincial government might also enact legislation shielding it from any claims of additional compensation.

Another option would be to replace some of the industrial and larger FIT contracts with a new regime whose main principle would be to provide a regulated rate of return to producers over the life of the contract. The micro-FITs could be adjusted collectively under the same principle. The costs of this process to a new government, including any actual compensation paid to successful litigants, would likely be small compared to the permanent savings to ratepayers.

How big would those savings be? It is feasible that a total of perhaps $1-2 billion per year could be saved under a combination of the options (including by also looking at the second tier contracts), an amount equivalent to the annual borrowing under the Wynne government’s FHP.

Conclusion

Before the implementation of the Fair Hydro Plan, high electricity prices were the number one concern of voters in Ontario. As voters head to the polls this spring, electricity bills may be just one of many ballot box issues. In that sense, the plan appears to have “worked” for the Liberal government. Down the road, however, other people, and other governments, will have to deal with the fallout of these decisions.

For those outside of Ontario and Canada this process is a cautionary tale about the interplay of some of the most important political and economic trends many societies face today. Outright and sudden privatization of the electricity supply was not considered politically feasible, so privatization was brought in gradually and stealthily. The NDP voted in favour of the Green Energy Act in 2009. Unlike the PCs, who have vowed to repeal it, the NDP and the Greens appear to continue to support it in principle.

Initially, criticism by progressive groups was muted by the promise of energy democratization and the content of that privatization: renewables generation that helped reduce emissions and pollution, and had widespread support from environmental organizations.

In Ontario, the electricity sector became a prime case study of some of the inequality-creating trends buffeting our societies. Corporations and their investors, who secured lucrative contracts, and high-income households that could afford rooftop solar panels made out like bandits, while low-income households in Ontario faced growing electricity poverty. When prices became a political liability, the government responded not by going after the power producers, but rather by borrowing on behalf of ratepayers (with a cut to the investment bankers, of course).

While the decarbonization of the electricity sector is well-advanced, it has barely begun in most other sectors in Ontario and elsewhere. There is much to be learned from the experience so far. Objectives matter, but Ontario shows that governance, policy and implementation matter even more. Calls for a low-carbon future should be resisted if, like in Ontario, they are based on privatization, unregulated contracts and financing mechanisms that enrich the private sector.

The principles of climate justice and a “fair transition” require that we reject the idea that greater suffering by low-income households, increased inequality and massive ratepayer debt are simply the “price to be paid” for a low carbon future. We have the tools to do better.

Edgardo Sepulveda is an independent consulting economist with more than two decades of utility (telecommunications) policy and regulatory experience. He writes about electricity, inequality and other economic policy issues as the Progressive Economics Forum.