Corporations & Corporate Power

Our publications are available to all at no cost. Please support the CCPA and help make important research and ideas available to everyone. Make a donation today.

-

Will a higher capital gains tax inclusion rate double corporate investments?

Corporate Canada’s well-oiled public relations machine is in full swing against a minor change to Canada’s tax system, which would increase the capital gains inclusion…

-

Workers’ income is 100% taxable. Capital gains should be too

This week, the federal government is putting forward a motion to pass its change—announced in the 2024 federal budget—in how capital gains are taxed. The feds are…

-

Expanding democratic employee ownership in Canada

VANCOUVER — The federal government is considering ways for employees to have more ownership and control in their workplace by tabling legislation to create a new…

-

Canadian CEO pay breaks all records, reflecting a new Gilded Age for Canada’s rich: report

OTTAWA—Canada’s 100 highest-paid CEOs again broke every compensation record on the books in 2022, according to a new report by the Canadian Centre for Policy…

-

Highest-paid 100 CEOs, by province: Ontario’s a jawdropper

Which provinces are Canada’s richest CEOs headquartered in—and how much do they make compared to average workers in each province?

-

The Monitor, July/August 2023

Neoliberalism is like a zombie that won’t die Download 5.58 MB Browse the latest edition of The Monitor online here Before it was an entrenched…

-

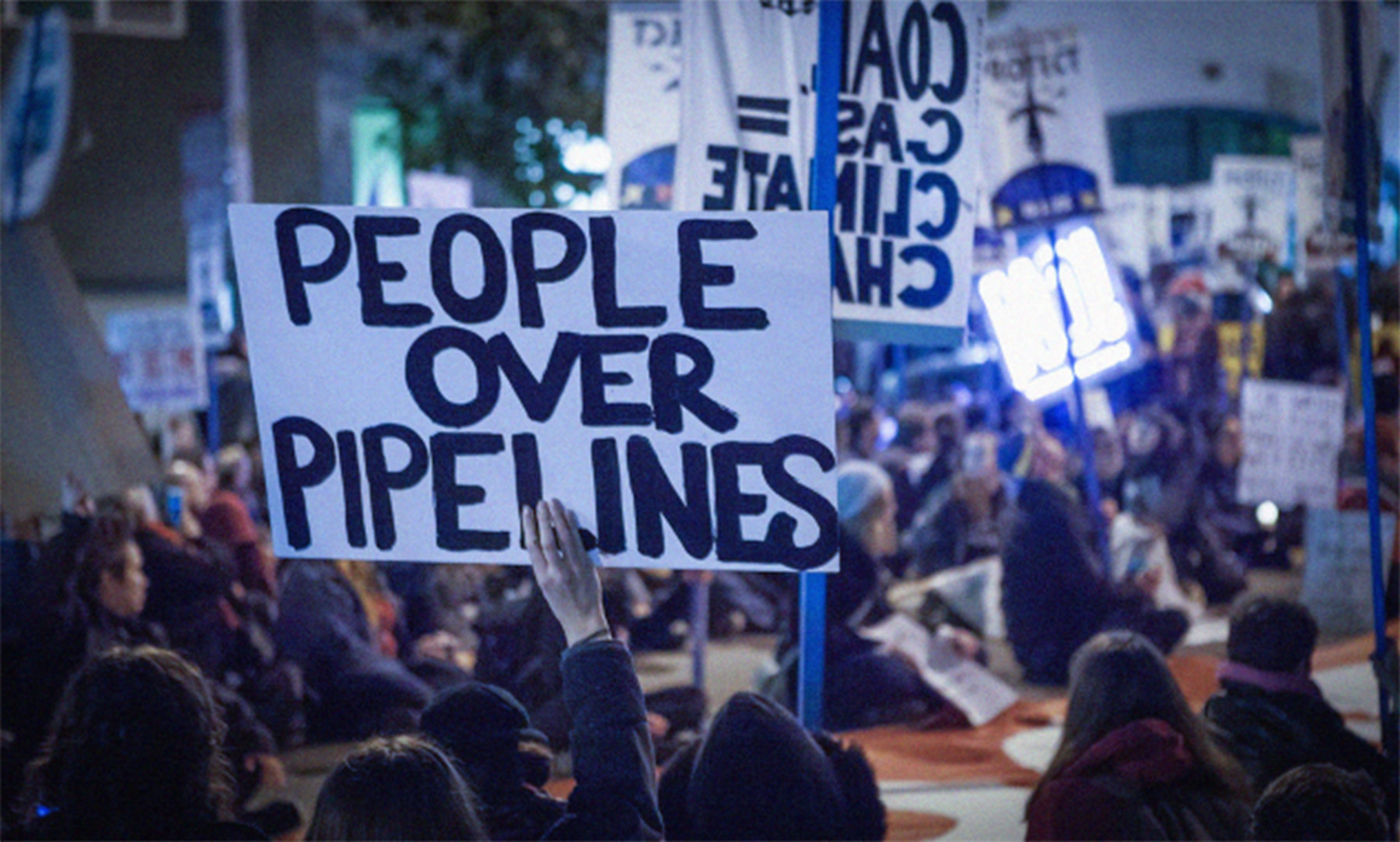

Canada’s options for intervening in the Keystone XL CUSMA lawsuit

A briefing paper from the Trade and Investment Research Project Download 3.8 MB 19 pages Read the full report online here. TC Energy’s $15 billion…

-

Fast Facts: Whose Freedom?

The Convoy that took over Ottawa for a month last year just met outside Winnipeg this past weekend. While the right to protest is an…

-

NAFTA’s Shadow of Obstruction

Investor rights in the expired North American Free Trade Agreement continue to undermine democratic decision-making and climate policy in Mexico, Canada, and the United States.…

-

Corporate profits capturing more of economic recovery compared to any recession in last half century

Corporate profits are capturing more economic growth than in any previous post-recession recovery period over the past 50 years; workers are capturing among the least…

Updates from the CCPA

Read the latest research, analysis and commentary on issues that matter to you.

CCPA Updates