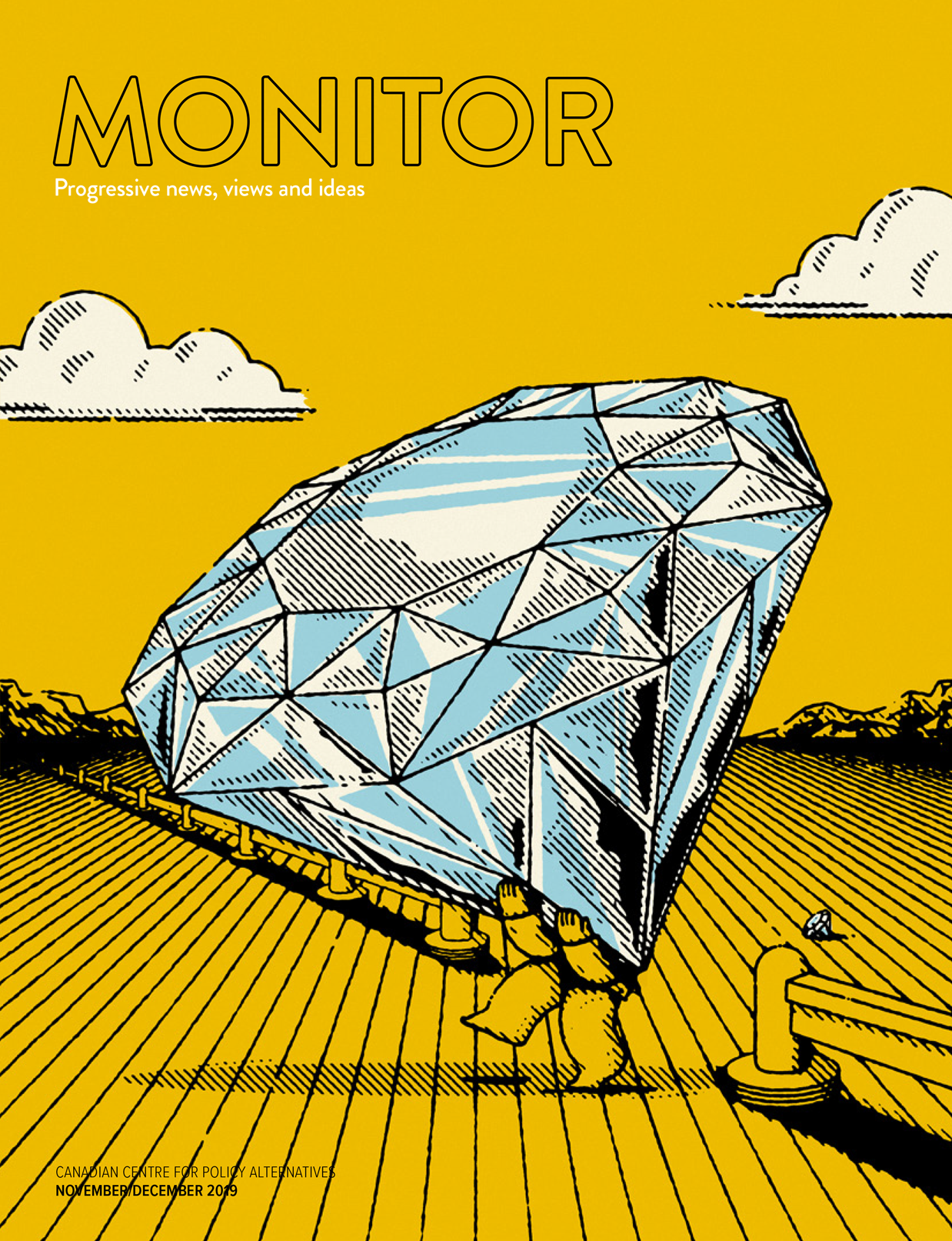

Tax Fairness Now!

Taxes are the foundation of a healthy democracy. They fund the public services we depend on every day: roads, schools, community and social services, health care, justice, environmental protection and much more. But over two decades now, governments have undermined the progressivity of our tax system by cutting corporate and top income tax rates and letting tax loopholes proliferate. The top 1% of Canadians by income now pay a lower overall rate than all other income groups, including the poorest 10%.

Emerging from its 43rd federal election, Canada faces no shortage of urgent domestic and global challenges. We can afford to fund solutions to crises like poverty, housing and climate change, but substantial progress will require more funding and that should come from making our tax system fairer. This special edition of the Monitor explores how we can do that.

Get The Monitor delivered to your inbox:

Subscribe-

These rich folks want their inheritances taxed!

We are living with vast discrepancies between rich and poor in Canada. That much is undeniable. According to the Broadbent Institute, 10% of Canadians held almost…

-

Canada’s failed corporate tax cutting binge

Corporate income tax has long been a leading provider of government revenue. Unfortunately, large sections of the media and policy-making community have accepted the notion,…

-

Should billionaires continue to exist?

Wealth taxation is back on the progressive political agenda. It is both a refreshing new idea and a return to vogue of a policy established…

-

What riches await…

Mining enjoys massive government support in Canada. Politically, it’s treated as a preferred development option for remote communities and Indigenous peoples. Former Saskatchewan premier Brad…

-

The case for transparency in the mining, oil and gas sector

Canada is one of the biggest extractive sector players in the world. We are home to approximately 60% of the world’s mining companies, and the…

-

An irresistible march toward fiscal justice

Échec aux paradis fiscaux was founded in 2011 by a small group of unions and civil society organizations fed up with how easily corporations and high-wealth…

-

A “soft target for crooks and kleptocrats”

When John Penrose visited Canada this year to address a global anti-corruption summit, he brought some advice for his host country. The U.K. member of parliament…

-

Oh Canada, our home and native tax haven

Imagine you’re a lawyer who specializes in international taxation. You work at a prestigious firm whose clients include the world’s rich and powerful: Russian oligarchs,…

-

A progressive foundation, but so much more to do

Canada’s income tax system has a lot going for it. On balance, its rate structure is progressive. While there are flaws in our system of…

-

How high should top tax rates go?

U.S. Congresswoman Alexandria Ocasio-Cortez provoked a lot of hostile—and positive—reaction earlier this year when she proposed the United States should introduce a top tax rate…

-

Summer of our digital discontent

Facebook, Google, Apple, Amazon, Netflix and other tax-avoiding internet giants were in the news a lot this summer. Much of the credit for this can…

-

Time to step up for tax justice

When we think about tax havens the picture we see is usually of a small tropical island, its palm-lined colonial streets swarming with slick, shady…

-

The promise and reality of gender budgeting

You can’t assume that government budgets affect men and women the same way—or other groups for that matter—since men and women generally occupy different social…