Energy Policy

Our publications are available to all at no cost. Please support the CCPA and help make important research and ideas available to everyone. Make a donation today.

-

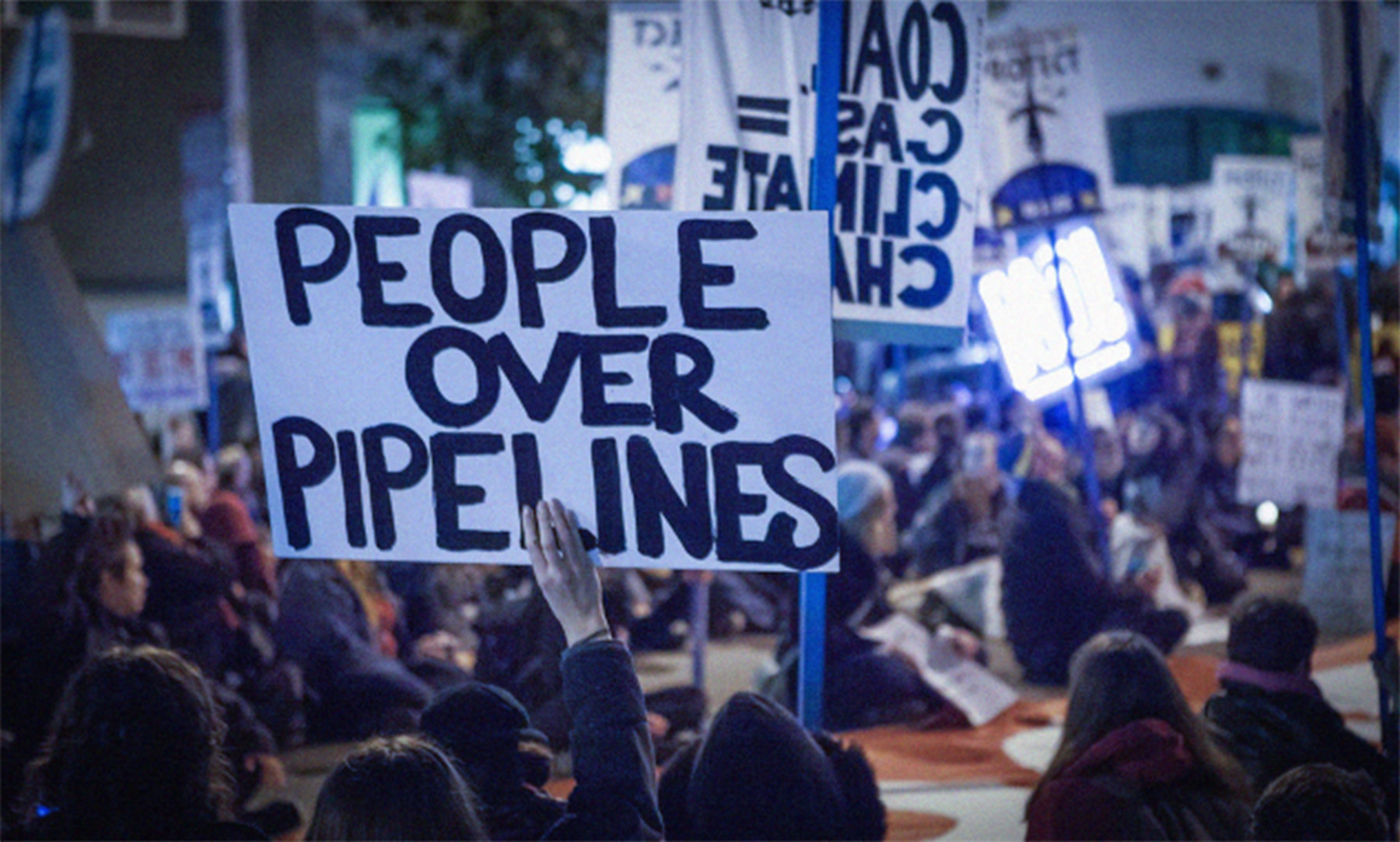

Northern pipeline the wrong nation-building plan

The Western Canadian climate-induced wildfires show that the time for action on climate is now. But earlier this month, the Premier of Mantioba pitched a…

-

Painting itself into a corner: LNG and the climate-affordability trade-off in B.C.

The B.C. government has painted itself into a corner by claiming to be climate action leaders while at the same time encouraging increased gas production for export

-

New Report Unlocks Jobs and Climate Solutions Through Residential Retrofits

12:00 PM CST For Immediate Release (Winnipeg, Treaty One):

-

Is Manitoba willing to accept nuclear waste risks?

Previously published in the Winnipeg Free Press August 2, 2024

-

TC Energy loses $15-billion NAFTA lawsuit against U.S.

TC Energy has reached the end of the line in its legal vendetta against the Biden administration for terminating the Keystone XL pipeline in January…

-

BC Solutions Magazine

News and commentary from the CCPA’s BC Office (Oct 2023) Download 3.27 MB12 pages BC’s carbon crossroads: The Energy Action Framework takes the wrong path…

-

Mapping Fossil Fuel Lock-In and Contestation in Eastern Canada

Download 1.42 MB33 pages In partnership with the CCPA-British Columbia and the Corporate Mapping Project, this report highlights fossil fuel lock-in in Eastern Canada mapping the…

-

Mapping Fossil Fuel Lock-In and Contestation in Eastern Canada

Read the news release here.

-

Extractivisme fossile, verrou carbone et mobilisation sociale dans l’Est du Canada : un état des lieux

Download 1.51 MB32 pages Le nouveau rapport fait l’état des lieux de la vaste infrastructure existante et proposée pour l’exploration, l’extraction, le transport, le raffinage,…

-

Fast Facts: Whose Freedom?

The Convoy that took over Ottawa for a month last year just met outside Winnipeg this past weekend. While the right to protest is an…

Updates from the CCPA

Read the latest research, analysis and commentary on issues that matter to you.

CCPA Updates